-

【S&Pへの投資】払いすぎた税金を取り戻す!「外国税額控除」

【米国株デビューした人へ】払いすぎた税金を取り戻す!「外国税額控除」をやさしく解説 最近、新NISAの影響もあって、米国株や「S&P500」などのインデ…

-

💰 【節税】知らなきゃ損?配当控除で税金を取り戻す

皆さん、こんにちは! 新NISAなどで投資を始めた方も多いと思いますが、特定口座で**「配当金」**を受け取っているそこのあなた。 「20%くらい税金引かれてる…

-

📈 特定口座(源泉徴収あり)でも確定申告が必要な「4つのケース」

「源泉徴収あり」なら放置でOK…というのはあくまで「義務がない」だけ。以下の状況に当てはまるなら、申告することで税金が戻ってくる可能性があります。 ⚠️ 要注意…

-

Due date of Tax Return(Kakutei Shinkoku) is 3/16!

Working in Japan as an expat brings plenty of perks—amazing food, efficient trai…

-

交際費・飲食費のルールも激変!【令和8年度改正

設備投資の特例と並んで注目したいのが、「飲食費」に関連する税制の見直しです。物価高の影響で「これまでの基準では足りない」という現場の声に応える内容となっています…

-

「少額減価償却資産の特例」が40万円に拡充

中小企業の設備投資を強力に後押しする「少額減価償却資産の取得価額の損金算入の特例」が、令和8年度の税制改正で見直されます。今回の改正は、単なる期間延長だけでなく…

-

2026年度(令和8年度)の税制改正大綱が決定し、個人事業主の確定申告を取り巻く環境は大きく変わります!

1. インボイス制度「2割特例」の終了とその後 インボイス登録をした小規模事業者の税負担を「売上税額の2割」に抑えていた激変緩和措置が、2026年9月末をもって…

-

【For Foreign Employees in Japan】Do You Earn Over 20 Million Yen or Have Side Income? Here’s What You Need to Know About Tax Filing

Greetings from Kawanishi CPA/Tax Accounting Office. If you’re a foreign pr…

-

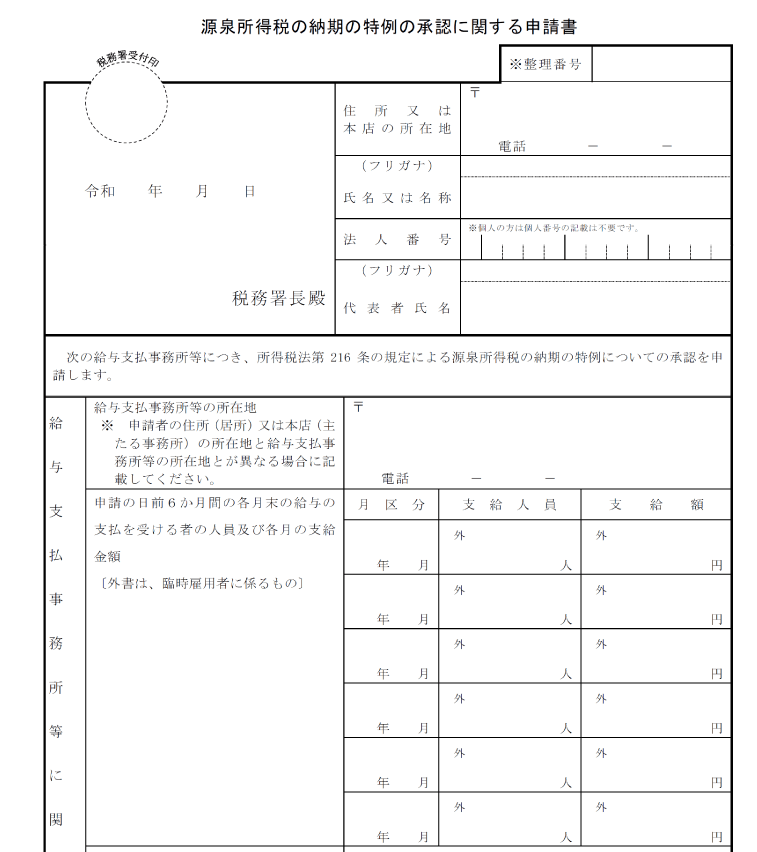

7/10納期限(源泉所得税)

📆 源泉所得税の納期(通常の場合) ◆ 原則の納期 源泉徴収した所得税は、翌月10日までに納付しなければなりません。 支払月 納期限 6月 7月10日 7月 8…

-

[2025 Edition] Everything about hometown tax! Overview of the system, changes, how to read your resident tax notice, and how to calculate the limit

Hello! In this article, we will explain the "Hometown Tax" system, which is becoming more and more popular every year, in an easy-to-understand manner, with the latest information for 2025. "I don't really understand how the system works"...

-

🔍 What is depreciable asset tax? Checklist included

This is a type of fixed asset tax, which is levied on "business assets other than land and buildings." For example, the following business equipment and fixtures are subject to this tax: 🧾 Here are the items that sole proprietors must declare…

-

Tax calendar for self-employed individuals | A thorough explanation of the year's schedule!

For those who are always in a rush every year not knowing what to do and by when, we have compiled a tax schedule for the year by month! ✅ January | Full-scale from the beginning of the year! Year-end adjustments and depreciation...